Home affordability has reached its best level since early 2023 thanks to easing mortgage rates, according to ICE Mortgage Technology’s October ICE Mortgage Monitor Report.

The new report cited 30-year mortgage rates averaging 6.26% in mid-September while the monthly principal and interest (P&I) payment on an average-priced home declined to $2,148, or 30% of the median US household income. ICE’s report noted that P&I costs have declined from 32% earlier this summer and are also down from their 35% peak in late 2023.

However, while nearly a dozen of the nation’s 100 largest housing markets — primarily in the Midwest — are near long-term average affordability levels, coastal markets continue to have pricing challenges. ICE observed that Los Angeles residents need to devote 62% of their median income to afford an average-priced home.

Furthermore, annual home price growth rose by 1.2% in September after eight months of slowing, due primarily to a lower inventory and improved affordability. Nationally, listings remain 17–19% below 2017–2019 norms.

The ICE data also noted that the average credit score for purchase locks climbed above 736, the highest recorded in the six-year history of ICE’s origination dataset, while debt-to-income (DTI) ratios for purchase rate locks have dropped to 38.5%, marking their lowest level in 2.5 years. For rate-and-term refinances, the average DTI has fallen to 34.1%, a 3.5-year low, while the average credit score has risen to 722, a nine-month high.

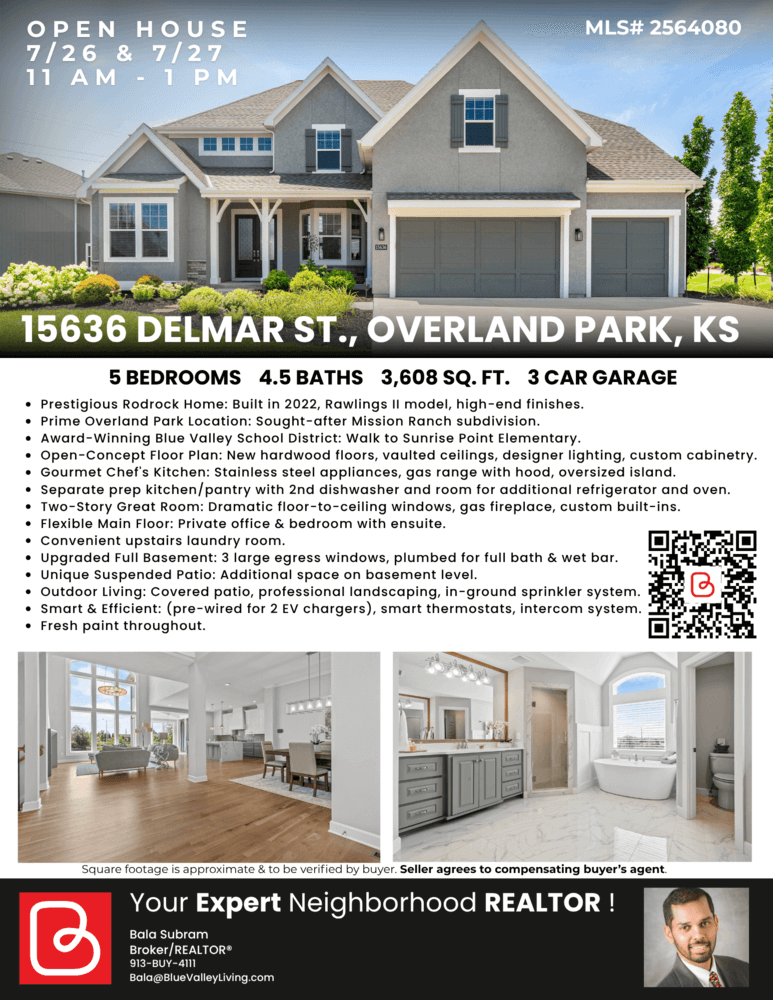

If I can help with your real estate needs, whether you are thinking about a home for yourself or a investment opportunity, I’m licensed in both Kansas and Missouri.

Sandy Herrick

ReeceNichols

913-205-4333

S